As an easyJet shareholder, the company’s future matters to me. And currently, it’s not looking great. The share price is down 47% in five years, having underperformed the FTSE 100 for the past three years.

Not that I’m considering selling my shares. Rather, I’m wondering if now is a good time to buy more, therefore decreasing my average spend per share.

First, I must try to figure out where the shares are headed.

Should you invest £1,000 in easyJet right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if easyJet made the list?

To do so, I’ve studied some key metrics that are used to forecast growth potential. Typical growth rate metrics include:

- Revenue and earnings (net income)

- Price-to-earnings (P/E) ratio

- Price-to-earnings-to-growth (PEG) ratio

- Return on equity (ROE)

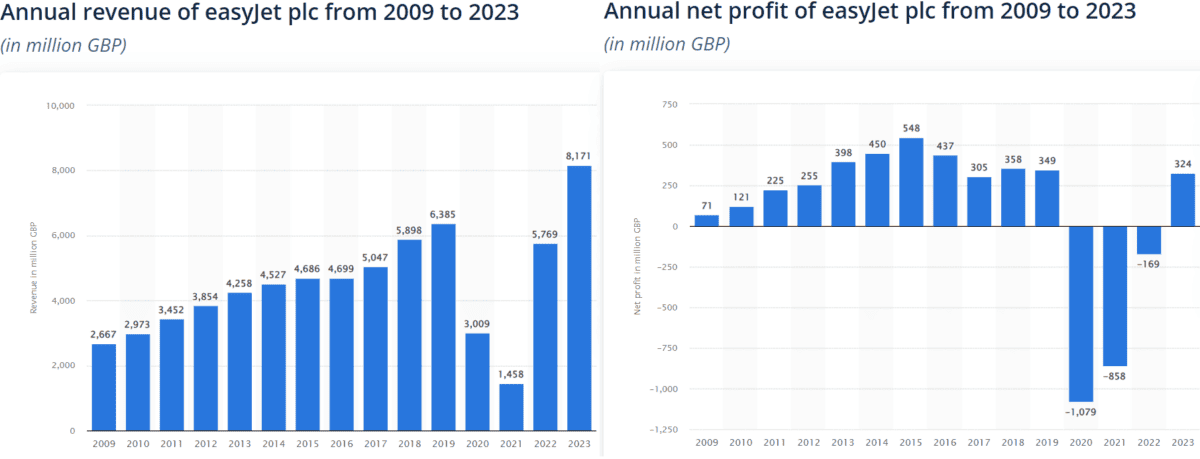

Revenue and earnings

Revenue is the total income a company generates, while earnings are the profit remaining after expenses, taxes and other costs.

Airlines were among the worst affected firms during the pandemic and like many others, easyJet is yet to recover fully. It became profitable again this year, with earnings of £324m — slightly down over five years. But a similar event could render it unprofitable again, digging it even further into debt.

For now, revenue remains high, at £8.17bn.

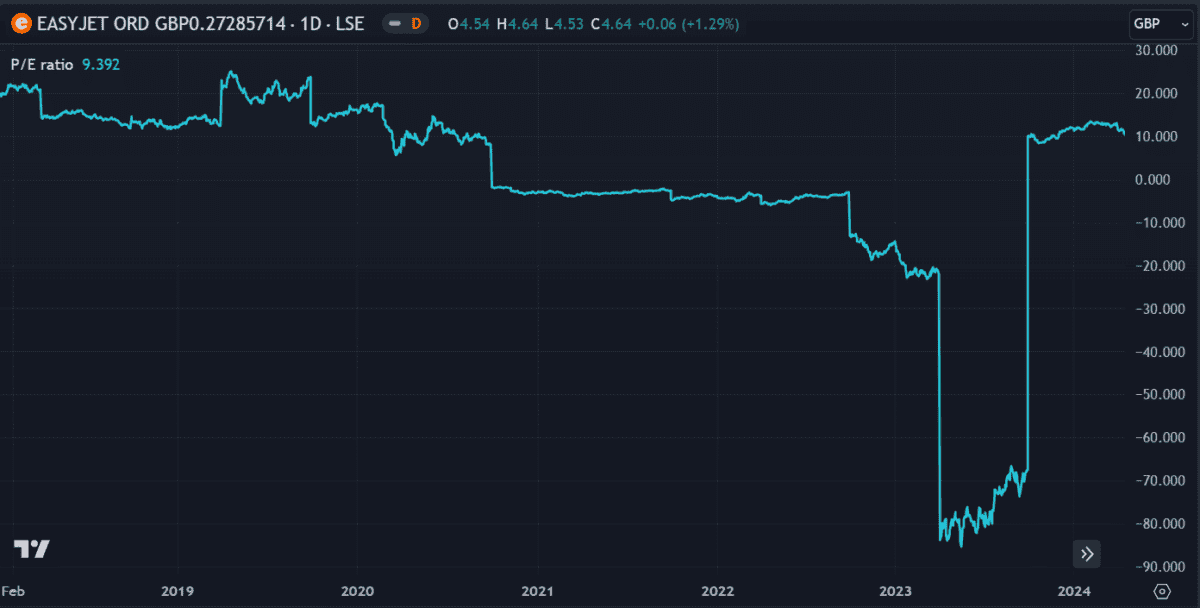

P/E ratio

easyJet’s P/E ratio looks low at 9.3, considering the UK market average is around 16.5. But budget travel is a fiercely competitive industry in Europe and easyJet faces stiff competition from rivals Ryanair, Wizz Air and Jet2. Currently, its P/E ratio is higher than Jet2 and Wizz Air.

On one hand, this could indicate that investors have higher confidence in the airline. But it also reduces its comparative growth potential. However, with earnings forecast to grow by 33%, its forward P/E ratio could drop to 7 in the coming 12 months.

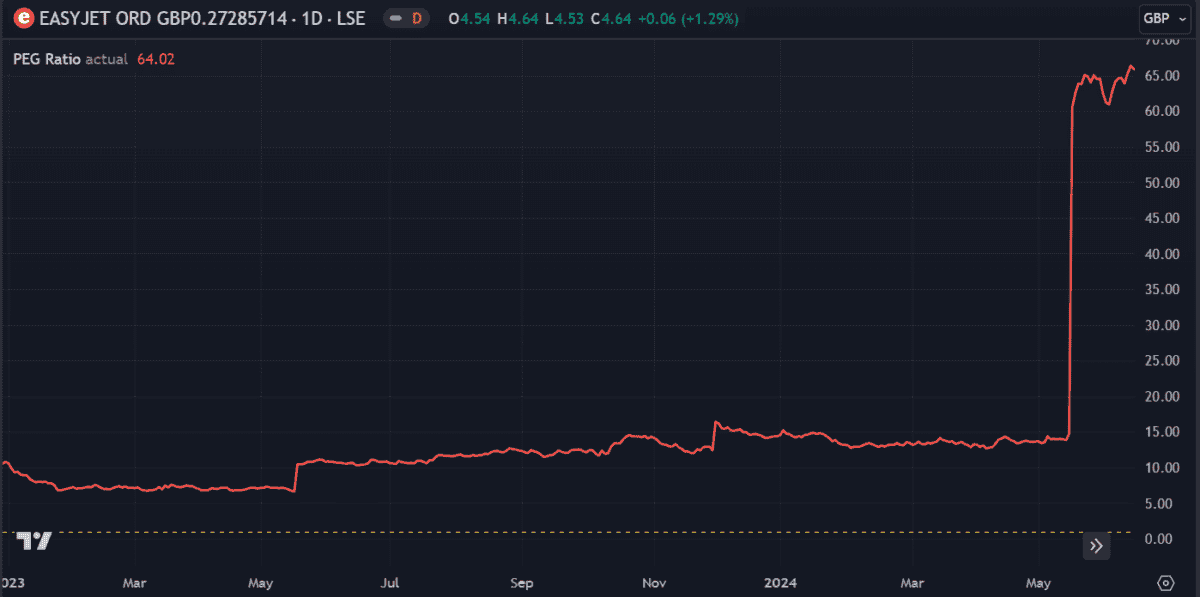

PEG ratio

The PEG ratio compares the price to expected earnings growth to gauge what kind of returns an investor could expect. If this metric is 1 (or 100%), earnings and price are expected to increase equally. Any number below 1 is good, as the price is expected to outperform earnings.

easyJet currently has a good PEG ratio of 0.64 (displayed on the chart as 64%). But its growth is threatened by any hiccup in the local economy that would cause consumers to cut down on unnecessary expenses.

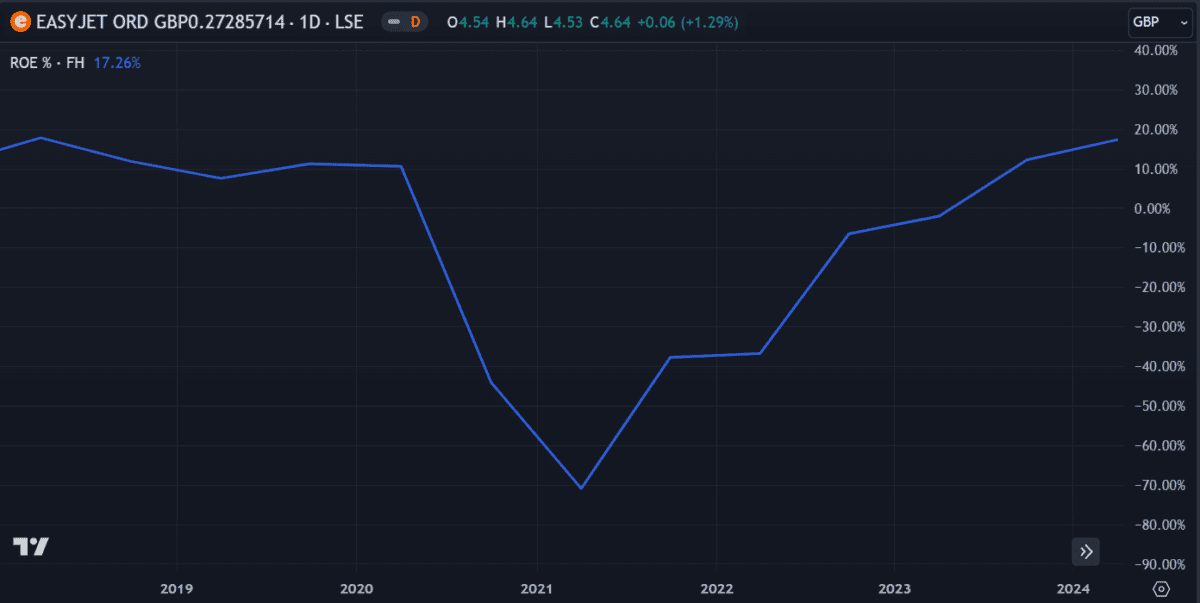

ROE

ROE is a measure of a company’s financial performance, calculated by dividing net income by shareholders’ equity. easyJet’s ROE has recently climbed back up to pre-Covid levels around 17%.

While the improvement is impressive, it remains considerably lower than the industry average of 30%. Hopefully, its growth will continue, prompting the share price to follow suit.

The bottom line

Several metrics in these charts indicate growth potential. In the most recent quarterly earnings report, passenger numbers rose 8% and profits increased 16%. This was boosted by growth in the airline’s new ‘holidays’ offering, which has proved popular.

At the same time, the share price continues to struggle and the stock carries several risks. I bought EZJ shares when air travel reopened as it seemed the most promising UK airline stock at the time.

So far, I’m disappointed in the performance and not inspired to buy more. But with no airline offering anything more promising, I’ll hold my shares for now and see where it goes.